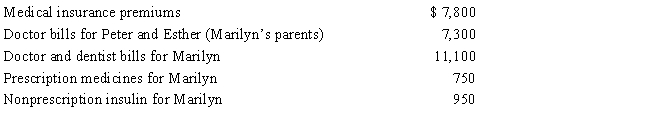

Marilyn, age 38, is employed as an architect. For calendar year 2017, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2017 and received the reimbursement in January 2018. What is Marilyn's maximum allowable medical expense deduction for 2017?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2017 and received the reimbursement in January 2018. What is Marilyn's maximum allowable medical expense deduction for 2017?

Definitions:

Defibrillator

A medical device used to deliver a therapeutic dose of electrical energy to the heart to treat life-threatening cardiac dysrhythmias, especially ventricular fibrillation and ventricular tachycardia.

Low-Density Lipoprotein

Often referred to as "bad" cholesterol, it transports cholesterol particles throughout your body and can build up on the walls of your arteries, potentially leading to heart disease.

Stenotic

Pertaining to a narrowing or constriction of a bodily passage or duct.

Hemorrhagic Stroke

A type of stroke caused by bleeding in the brain, resulting from the rupture of blood vessels, leading to damage in brain tissue.

Q5: Aaron is a self-employed practical nurse who

Q71: Barry purchased a used business asset (seven-year

Q85: Pat purchased a used five-year class asset

Q89: Jed is an electrician. Jed and his

Q99: All taxpayers are eligible to take the

Q105: Legal fees incurred in connection with a

Q112: During the current year, Eleanor earns $120,000

Q116: Jesse placed equipment that cost $48,000 in

Q140: Robert entertains several of his key clients

Q150: Aaron, a shareholder-employee of Pigeon, Inc., receives