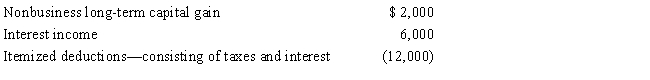

Jack, age 30 and married with no dependents, is a self-employed individual. For 2017, his self-employed business sustained a net loss from operations of $10,000. The following additional information was obtained from his personal records for the year:  Based on the above information, what is Jack's net operating loss for 2017 if he and his spouse file a joint return?

Based on the above information, what is Jack's net operating loss for 2017 if he and his spouse file a joint return?

Definitions:

Inaugural Address

The speech given by a president at the beginning of their term, outlining their vision and priorities for the administration.

Cuban Missile Crisis

A 13-day confrontation in 1962 between the United States and the Soviet Union over Soviet ballistic missiles deployed in Cuba, bringing the two superpowers closest to a nuclear conflict during the Cold War.

Sisterhood Is Powerful

A phrase symbolizing the unity and strength found in feminist movements, also a title of a classic anthology of women's writings.

Feminist Ideas

Ideas and doctrines advocating for equal rights for women and challenging gender norms and inequalities.

Q5: Because they appear on page 1 of

Q13: A cash basis taxpayer purchased a certificate

Q37: Land improvements are generally not eligible for

Q48: After graduating from college, Clint obtained employment

Q67: Workers' compensation benefits are included in gross

Q69: George purchases used seven-year class property at

Q86: Bill, age 40, is married with two

Q89: In order to protect against rent increases

Q90: A loss is not allowed for a

Q93: The earnings from a qualified state tuition