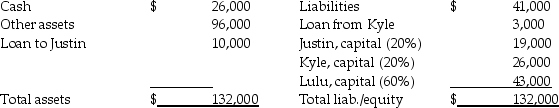

The Justin,Kyle,and Lulu partnership was dissolved by the partners on May 1,2014.Their balance sheet on that date is shown below:

In May,other assets with a book value of $46,000 were sold for $50,000 in cash.

In May,other assets with a book value of $46,000 were sold for $50,000 in cash.

Required:

Determine how the available cash on May 31,2014 will be distributed.

Definitions:

Bakke Case

A landmark decision by the U.S. Supreme Court in 1978 that ruled on the constitutionality of affirmative action policies in educational admissions processes.

Supreme Court

The highest federal court in the United States, which has the ultimate appellate jurisdiction and holds the power of judicial review.

Affirmative Action

Policies or measures that favor individuals belonging to groups known to have been discriminated against previously.

Constitutionality

The quality or state of being in accordance with the constitution, or being constitutionally valid.

Q1: Income attributable to the noncontrolling interest is

Q14: What is the goodwill on the consolidated

Q15: What is a Technical Advice Memorandum?

Q21: Daniel,Ethan,and Frank have a retail partnership business

Q22: If a partnership agreement does not specify

Q27: The accounting equation for an agency fund

Q33: Governmental not-for-profit entities follow GASB.

Q38: Which type of trust is created pursuant

Q52: Arizona is in the jurisdiction of the

Q86: Tax planning usually involves a completed transaction.