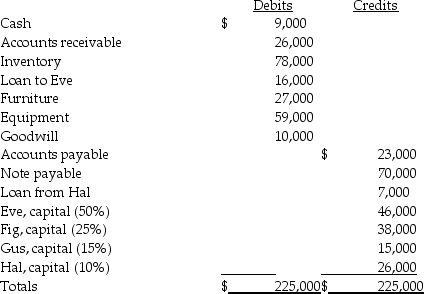

Eve,Fig,Gus,and Hal are partners who share profits and losses 50%,25%,15%,and 10%,respectively.The partnership will be liquidated gradually over several months beginning January 1,2014.The partnership trial balance at December 31,2013 is as follows:

Required:

Required:

Prepare a cash distribution plan for January 1,2014,showing how cash installments will be distributed among the partners as it becomes available.Prepare vulnerability rankings for the partners and a schedule of assumed loss absorption.

Definitions:

Q1: When liquidating a partnership the first payment

Q3: Gains and losses from foreign currency transactions

Q15: Pheasant Corporation owns 80% of Sal Corporation's

Q17: Late filing and statute limitations (deficiency situations)

Q17: On November 1,2013,Stateside Company (a U.S.manufacturer)sold an

Q32: Which fund would most likely report depreciation

Q32: Piel Corporation (a U.S.company)began operations on January

Q42: Warren Peace passed away,with his will leaving

Q44: Pancino Corporation owns a 90% interest in

Q194: Revenue Agent's Report (RAR)