Use the following information to answer the question(s) below.

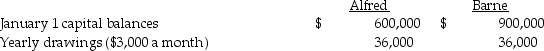

Alfred and Barne share profits and losses in a ratio of 2:3, respectively, after salary allowances, interest allowances and bonus allocations. Alfred and Barne receive salary allowances of $30,000 and $60,000, respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners' drawings are not used in determining the average capital balances. Total net income for 2014 is $180,000. If net income after deducting the interest and salary allocations is more than $60,000, Barne receives a bonus of 5% of the original amount of net income.

-If the partnership experiences a net loss of $60,000 for the year,what will be the final net amount of profit or (loss) closed to each partner's capital account?

Definitions:

Spinal Cord

A long, thin, tubular structure made up of nervous tissue, which extends from the brain down the back, transmitting nerve signals between the brain and the rest of the body.

Human Childbirth

The process of delivering a baby from the uterus to the outside world, typically through stages of labor and delivery.

Birth Canal

The passageway comprising the cervix, vagina, and vulva through which a fetus travels during birth.

Cultural Practices

The shared activities, rituals, and norms that define the lifestyle of a particular group or society.

Q3: Controlling interest share of consolidated net income

Q12: Voluntary health and welfare organizations<br>A)may not have

Q17: The accounting equation for an agency fund

Q20: In a Statement of Cash Flows for

Q20: The partnership of Georgia,Holly,and Izzy was dissolved,and

Q24: Government enter the annual budget in the

Q46: Revenue Procedures deal with the internal management

Q52: Arizona is in the jurisdiction of the

Q85: Which of the following indicates that a

Q113: Under what conditions is it permissible, from