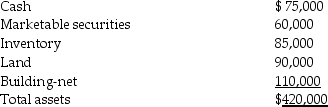

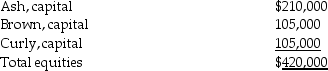

A summary balance sheet for the Ash,Brown,and Curly partnership on December 31,2014 is shown below.Partners Ash,Brown,and Curly allocate profit and loss in their respective ratios of 2:1:1.The partnership agreed to pay partner Brown $135,000 for his partnership interest upon his retirement from the partnership on January 1,2015.The partnership financials on January 1,2015 are:

Assets

Equities

Equities

Required:

Required:

Prepare the journal entry to reflect Brown's retirement from the partnership:

1.Assuming a bonus to Brown.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Definitions:

Remotely Created Checks

Checks that are created by the payee using the payer’s bank account information, without the payer’s direct signature, often used for telephone or online transactions.

Implies

Suggests or indicates something without expressing it directly.

Draws

In a financial context, it refers to a type of credit advance or salary payment made against future earnings or revenue.

Check

A written, dated, and signed instrument that contains an unconditional order directing a bank to pay a definite sum of money to a payee.

Q3: Wild West,Incorporated (a U.S.corporation)sold inventory to a

Q4: What is the fair value of the

Q8: Austin contributes his computer equipment to the

Q8: The following information regarding the fiscal year

Q14: Silvia Peacock has been appointed to

Q16: The accounting equation for a governmental fund

Q29: Not-for-profits have three classes of net assets

Q35: Assume you are preparing journal entries for

Q44: Partel Corporation purchased 75% of Sandford Corporation

Q47: Creditors of the partnership may seek the