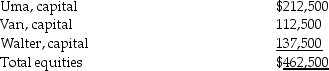

A summary balance sheet for the Uma,Van,and Walter partnership on December 31,2014 is shown below.Partners Uma,Van,and Walter allocate profit and loss in their respective ratios of 4:5:7.The partnership agreed to pay Walter $227,500 for his partnership interest upon his retirement from the partnership on January 1,2015.Any payments exceeding Walter's capital balance are treated as a bonus from partners Uma and Van.

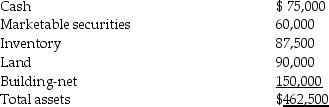

Assets

Equities

Equities

Required:

Required:

Prepare the journal entry to reflect Walter's retirement.

Definitions:

Marketing Department

A division within a company responsible for promoting products or services, brand management, and market research.

Crossover SUV

A type of sports utility vehicle that features a unibody construction, blending features of passenger cars with those of traditional SUVs for increased efficiency and comfort.

Satisfied Needs

The fulfillment of a consumer's requirements or desires through the consumption of products or services.

Communicate

The process of conveying information, feelings, or ideas from one person or group to another through various means.

Q7: What is Goldberg's percentage ownership in Savannah

Q10: Permanent funds are normally for nonexpendable resources

Q14: A Capital Projects Fund awards the construction

Q16: On December 31,2013,Pat Corporation has the

Q27: Assume the parent company theory is used.On

Q29: The unadjusted trial balance for the general

Q40: Plymouth Corporation (a U.S.company)began operations on

Q40: What is the total amount for the

Q43: The noncontrolling interest share for 2014 was<br>A)$18,000.<br>B)$22,000.<br>C)$23,000.<br>D)$27,000.

Q49: The gift shop of a nonprofit,private hospital