Use the following information to answer the question(s) below.

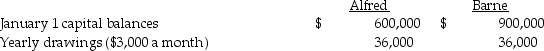

Alfred and Barne share profits and losses in a ratio of 2:3, respectively, after salary allowances, interest allowances and bonus allocations. Alfred and Barne receive salary allowances of $30,000 and $60,000, respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners' drawings are not used in determining the average capital balances. Total net income for 2014 is $180,000. If net income after deducting the interest and salary allocations is more than $60,000, Barne receives a bonus of 5% of the original amount of net income.

-What is the total amount for the allocation of interest,salary,and bonus,and how much over-allocation is present?

Definitions:

Minimizing Resistance

Refers to strategies and efforts made to reduce opposition or reluctance towards change within an organization or individual.

Coaching

A developmental process where an individual, usually more experienced, supports and guides another individual to achieve specific personal or professional goals.

Force Field Analysis

A management technique developed by Kurt Lewin, used to identify and analyze the forces that affect change within an organization.

Unfreezing

The process of making individuals more open to change by overcoming inertia and dismantling existing mindsets.

Q1: The Leo,Mark and Natalie Partnership had the

Q1: A forward contract used as a cash

Q6: In a liquidation under Chapter 7,the trustee<br>A)may

Q15: When a corporation's total liabilities are greater

Q17: If the bonds were originally issued at

Q19: Receipts due but unpaid at the date

Q27: Any distribution to partners prior to gains

Q28: Gonne Corporation is being liquidated under Chapter

Q30: Under the entity theory,subsidiary assets and liabilities

Q148: More rapid expensing for tax purposes of