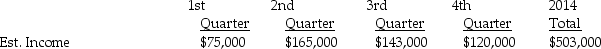

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2014,by quarter,is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2014.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2014.

Definitions:

Survival

The ability to continue living or existing, often despite difficult conditions or situations.

Commensalism

Species interaction that benefits one species and neither helps nor harms the other.

Mutualism

A type of symbiotic relationship between two species where both partners benefit from the interaction.

Predation

One species captures, kills, and eats another.

Q2: The death of a partner results in

Q4: Charin Corporation,a U.S.corporation,imports and exports small

Q5: Eve,Fig,Gus,and Hal are partners who share profits

Q8: How much should the Parminter's Investment in

Q8: How do treaties fit within tax sources?

Q11: The accounting equation for proprietary funds: Current

Q12: The proper sequence of events is<br>A)purchase order,appropriation,encumbrance,expenditure.<br>B)purchase

Q16: An intercompany gain or loss appears in

Q43: A deceased person that has a valid

Q48: What is the weighted-average capital for Bertram