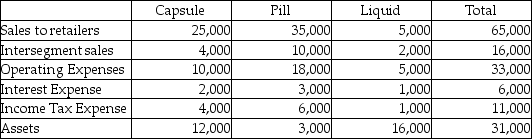

Osprin Corporation has three operating segments,as summarized below:

Required:

Required:

1.Using the revenue test,what is the minimum amount of revenue of a reportable segment?

2.Using the operating profit or loss test,what is the minimum amount of operating profit or loss of a reportable segment?

3.Using the asset test,what is the minimum amount of assets of a reportable segment?

4.Based on the three tests,which segments will be separately reported?

Definitions:

Tax Burden

The measure of taxes that individuals or businesses must pay as a portion of their income or profit, reflecting the financial impact of taxation.

Antipoverty Programs

Government initiatives aimed at reducing poverty and improving living standards for the poor through financial aid, education, and job training.

Benefits Principle

A tax policy principle suggesting that taxes should be levied according to the benefits received by the taxpayer from government services.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Q8: On January 1,2014,Bambi borrowed $500,000 from Lonni.The

Q21: The GAAP requires that corporations report both

Q24: A(n)_ sale is a sale by a

Q28: Not-for-profit,private colleges classify student unions,dining halls,and residence

Q30: On January 1,2014,Pilgrim Corporation,a U.S.firm,acquired ownership of

Q31: Bonds Payable appeared in the December 31,2013

Q32: Consolidated statements are appropriate when one corporation

Q49: An elimination entry at December 31,2014 for

Q50: Padhy Corporation owns 80% of Abrams Corporation,Abrams

Q71: Subtitle A of the Internal Revenue Code