Use the following information to answer the question(s) below.

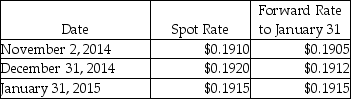

On November 2, 2014, Bellamy Corporation sells product to their Danish customer. At the same time, Bellamy signed a forward contract to sell 200,000 Danish krone in ninety days to hedge the account receivable at $0.1905, the 90-day forward rate. The receivable is expected to be collected in ninety days. Assume the forward contract will be settled net and this is a fair value hedge. The related exchange rates are shown below:

-Assuming a present value factor of 1 for simplicity,what is the fair value of this forward contract on January 31?

Definitions:

Break-Even Point

The level of output or sales at which a company does not make a profit or loss, but all costs are covered.

Operating Leverage

measures a company's fixed costs relative to its total costs, indicating how a change in sales will affect its operating income.

Forecasting Error

Forecasting error refers to the difference between actual outcomes and previously predicted values, directly impacting planning and decision-making.

Operating Leverage

A measure of how revenue growth translates into growth in operating income, indicating the degree to which a company can leverage fixed costs.

Q3: Wild West,Incorporated (a U.S.corporation)sold inventory to a

Q11: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q11: For each of the following events or

Q12: Under the temporal method monetary assets and

Q15: When examining revenue transactions,which of the following

Q17: Marshfield Hospital is a private,not-for-profit hospital.The following

Q24: Using the original information,the balances for the

Q25: If a U.S.company is preparing a journal

Q39: Nettle Corporation is preparing its first quarterly

Q46: When a subsidiary has preferred stock that