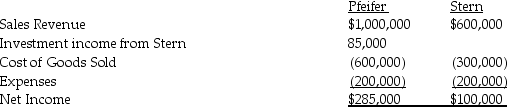

Pfeifer Corporation acquired an 80% interest in Stern Corporation several years ago when the book values and fair values of Stern's assets and liabilities were equal.At the time of acquisition,the cost of the 80% interest was equal to 80% of the book value of Stern's net assets.Separate company income statements for Pfeifer and Stern for the year ended December 31,2014 are summarized as follows:

During 2013,Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31,2013.During 2014,Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31,2014 inventory.

During 2013,Pfeifer sold merchandise that cost $120,000 to Stern for $180,000.Half of this merchandise remained in Stern's inventory at December 31,2013.During 2014,Pfeifer sold merchandise that cost $150,000 to Stern for $225,000.One-third of this merchandise remained in Stern's December 31,2014 inventory.

Required:

Prepare a consolidated income statement for Pfeifer Corporation and Subsidiary for 2014.

Definitions:

Acids

Substances that release hydrogen ions (H+) when dissolved in water, typically having a sour taste and capable of turning blue litmus paper red.

Bases

Chemical substances that can accept hydrogen ions (H+) and are characterized by a pH greater than 7 when dissolved in water.

Hydrophilic

Describing molecules or substances that have a natural affinity for water and can dissolve in or absorb water easily.

Hydrophobic

A characteristic of molecules or substances that do not readily mix with or are repelled by water, often due to nonpolar characteristics.

Q1: Jersey Company acquired 90% of York Company

Q10: For foreign subsidiaries whose functional currency is

Q11: Which method must be used if ASC

Q11: On October 15,2014,Napole Corporation,a French company,ordered merchandise

Q12: Under the equity method of accounting parent-retained

Q15: 13-40.A record stating the amounts that are

Q18: The transfer of nondepreciable plant assets between

Q39: Platt Corporation paid $87,500 for a 70%

Q41: Swamp Co.,a 55%-owned subsidiary of Pond Inc.,made

Q45: Paglia Corporation owns 80% of Aburn Corporation