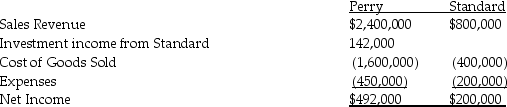

Perry Instruments International purchased 75% of the outstanding common stock of Standard Systems in 1997 when the book values and fair values of Standard's assets and liabilities were equal.The cost of Perry's investment was equal to 75% of the book value of Standard's net assets.Separate company income statements for Perry and Standard for the year ended December 31,2014 are summarized as follows:

During 2014,the companies began to manage their inventory differently,and worked together to keep their inventories low at each location.In doing so,they agreed to sell inventory to each other as needed at a markup of 10% of cost.Perry sold merchandise that cost $100,000 to Standard for $110,000,and Standard sold inventory that cost $80,000 to Perry for $88,000.Half of this merchandise remained in each company's inventory at December 31,2014.

During 2014,the companies began to manage their inventory differently,and worked together to keep their inventories low at each location.In doing so,they agreed to sell inventory to each other as needed at a markup of 10% of cost.Perry sold merchandise that cost $100,000 to Standard for $110,000,and Standard sold inventory that cost $80,000 to Perry for $88,000.Half of this merchandise remained in each company's inventory at December 31,2014.

Required:

Prepare a consolidated income statement for Perry Corporation and Subsidiary for 2014.

Definitions:

Open-Market Operations

The buying and selling of government securities by a central bank to control the money supply and interest rates.

Federal Reserve

The primary banking authority in the United States, tasked with overseeing monetary policy, managing bank regulation, and maintaining financial system stability.

Money Multiplier

The amount of money the banking system generates with each dollar of reserves.

Reserve Ratio

The fraction of deposits that banks hold as reserves.

Q3: On January 1,2014,Parton Corporation acquired an 80%

Q4: Title insurance:<br>A) insures against losses on a

Q7: The seller-lessee cannot account for the transaction

Q12: After eliminating/adjusting entries are prepared,what was the

Q14: Astrotuff Company is planning to purchase 200,000

Q28: The direct method of the consolidated cash

Q34: 12-24.The following influence a homeowner with negative

Q36: 18-12.In the event of a default,the development

Q42: Passcode Incorporated acquired 90% of Safe Systems

Q45: A highly-effective hedge of an existing asset