Use the following information to answer the question(s) below.

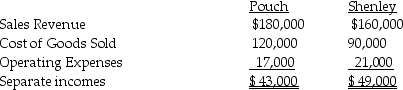

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1, 2014, when the book values of Shenley's assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets. During 2014, Pouch sold merchandise that cost $70,000 to Shenley for $86,000. On December 31, 2014, three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory. Separate incomes (investment income not included) of the two companies are as follows:

-The consolidated income statement for Pouch Corporation and subsidiary for the year ended December 31,2014 will show consolidated cost of sales of

Definitions:

Fiberglass Material

A composite material made from fine fibers of glass and often used in a variety of applications, including construction and automobile parts.

Q7: The treasury stock approach to account for

Q9: FASB ASC Topic 830 requires marking to

Q12: Under parent company theory,noncontrolling interest is classified

Q13: Unrealized profits or losses on plant assets

Q15: What is the amount of total assets?<br>A)$1,380,000<br>B)$1,402,000<br>C)$1,470,000<br>D)$1,875,000

Q22: The GAAP states a noncontrolling interest in

Q23: A parent company regularly sells merchandise to

Q28: If the sale of merchandise is denominated

Q32: The 2014 unrealized gain from the intercompany

Q34: Under parent company theory,noncontrolling interest is valued