Use the following information to answer question(s) below.

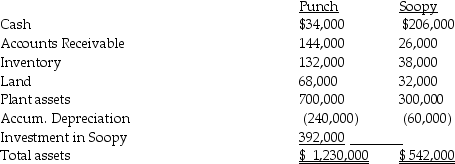

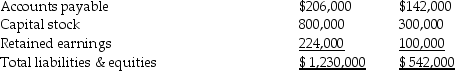

On January 1, 2014, Punch Corporation purchased 80% of the common stock of Soopy Co. Separate balance sheet data for the companies at the acquisition date (after the acquisition) are given below:

-What is the amount of total assets?

Definitions:

Risk Adjusted NPV

Net Present Value method adjusted for the risk associated with the uncertain cash flows, taking into account the variability of returns and the cost of capital.

Initial Cost

The initial expenditure required to acquire an asset, including the purchase price and any additional costs necessary to get the asset ready for its intended use.

Cash Inflows

Funds that are received, whether from business operations, investment returns, or financing activities.

Certainty Equivalent Approach

This is a method used in financial analysis to determine the value of risky investments by finding the risk-free cash flow amount that an investor would accept instead of taking a risk.

Q4: 10-32.A secondary mortgage market transaction that occurs

Q10: If an existing asset is being hedged,it

Q19: On November 1,2013,Athom Corporation purchased 5,000 television

Q28: What is Pew's income from Sordid for

Q32: Barnes Company entered into a forward contract

Q32: 20-31.The Real Estate Investment Trust Act authorizes:<br>A)

Q33: The balance sheets of Palisade Company

Q35: 20-20.The form of property ownership that suffers

Q36: On January 1,2014,Bosna borrowed $100,000 from Lenda.The

Q39: An entry is necessary to eliminate the