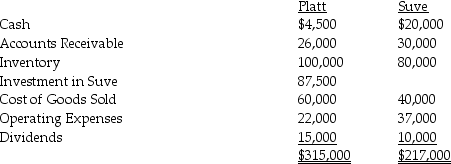

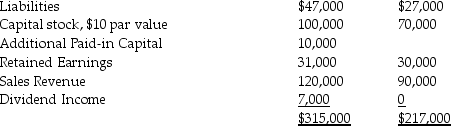

Platt Corporation paid $87,500 for a 70% interest in Suve Corporation on January 1,2014,when Suve's Capital Stock was $70,000 and its Retained Earnings $30,000.The fair values of Suve's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31,2014 are given below:

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

During 2014,Platt made only two journal entries with respect to its investment in Suve.On January 1,2014,it debited the Investment in Suve account for $87,500 and on November 1,2014,it credited Dividend Income for $7,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Platt and Subsidiary for the year ended December 31,2014.

2.Prepare a consolidated balance sheet for Platt and Subsidiary as of December 31,2014.

Definitions:

Common Goals

Shared objectives or aims among individuals or groups that motivate collective action towards achievement.

Soccer Team

A group of players forming one side in competitive soccer matches, working together to score goals and win games through strategic play and collaboration.

Writing About Leadership

The act of analyzing, discussing, or providing guidance on the qualities, processes, and outcomes related to leading individuals or organizations.

Researching Leadership

The systematic study and exploration of various theories, styles, and practices associated with leading individuals or groups in different contexts.

Q4: The capital asset pricing model (CAPM)suggests that

Q7: The GAAP requires the effective interest method

Q10: For mortgage securities:<br>A) a change in the market

Q15: Candy Corporation paid $240,000 on April 1,2013

Q18: Under the parent company theory,what amount of

Q21: Ivan has 14,000 barrels of oil

Q21: Bird Corporation has several subsidiaries that are

Q26: Preen Corporation acquired a 60% interest in

Q28: Pretax operating incomes of Panitz Corporation

Q36: Paroz Corporation acquired a 70% interest in