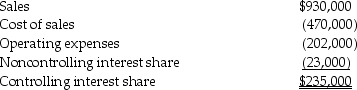

Pastern Industries has an 80% ownership stake in Sascon Incorporated.At the time of purchase,the book value of Sascon's assets and liabilities were equal to the fair value.The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets.At the end of 2014,they issued the following consolidated income statement:

Shortly after the statements were issued,Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation.In fact,Pastern had sold inventory that cost $80,000 to Sascon for $90,000,and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31,2014.

Shortly after the statements were issued,Pastern discovered that the 2014 intercompany sales transactions had not been properly eliminated in consolidation.In fact,Pastern had sold inventory that cost $80,000 to Sascon for $90,000,and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31,2014.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2014.

Definitions:

T Account

A graphical representation of a ledger account, used in accounting to depict debits and credits for a specific account.

Debit Side

refers to the left-hand side of a ledger account that records increases in assets, expenses, and decreases in liabilities and equity.

Credit Side

The right side of an account in double-entry bookkeeping, typically used to record increases in liabilities, revenue, or equity.

Basic Accounting Equation

The foundational accounting principle stating that Assets = Liabilities + Equity.

Q5: On December 31,2013,Lorna Corporation has the

Q10: 10-12.To be successful,MRSs need:<br>A) to avoid double

Q15: On November 1,2014,the Yankee Corporation,a U.S.corporation,purchased and

Q19: Functional currency is the currency of the

Q19: Panda Corporation purchased 100,000 previously unissued shares

Q21: Consider a sale of stock by a

Q22: With respect to the bond purchase,the consolidated

Q29: Pali Corporation exchanges 200,000 shares of newly

Q31: In 1960 Congress created the REIT structure

Q45: A disadvantage of filing a consolidated return