Packo Company acquired all the voting stock of Sennett Corporation on January 1,2014 for $90,000 when Sennett had Capital Stock of $50,000 and Retained Earnings of $8,000.The excess of fair value over book value was allocated as follows: (1)$5,000 to inventories (sold in 2014),(2)$16,000 to equipment with a 4-year remaining useful life (straight-line method of depreciation)and (3)the remainder to goodwill.

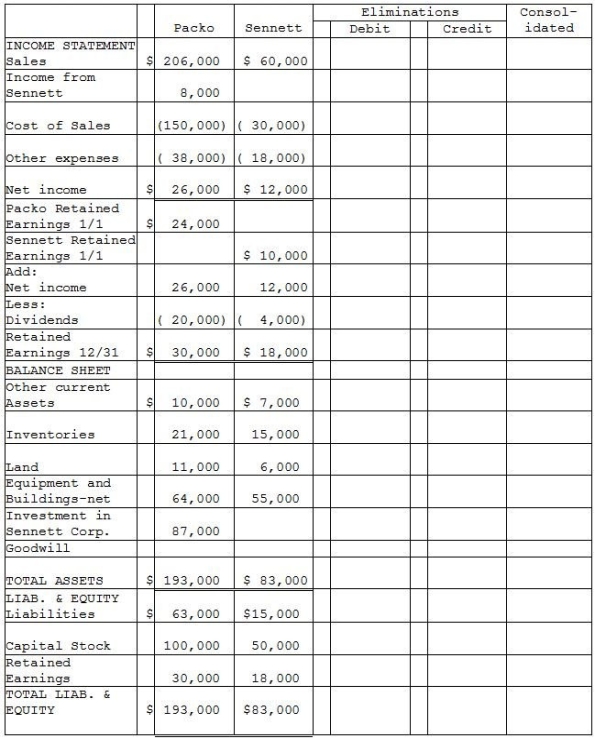

Financial statements for Packo and Sennett at the end of the fiscal year ended December 31,2015 (two years after acquisition),appear in the first two columns of the partially completed consolidation working papers.Packo has accounted for its investment in Sennett using the equity method of accounting.

Required:

Complete the consolidation working papers for Packo Company and Subsidiary for the year ending December 31,2015.

Definitions:

Predetermined Overhead Rate

A rate used to allocate manufacturing overhead costs to products or job orders, calculated based on estimated overhead costs and an allocation base such as direct labor hours.

Machine-Hours

An indicator reflecting the duration of machinery utilization during the manufacturing process, commonly employed in the distribution of manufacturing overhead expenses.

Manufacturing Overhead

Represents indirect costs involved in producing goods, including maintenance expenses, quality control, and equipment depreciation.

Variable Manufacturing Overhead

The portion of manufacturing overhead costs that vary directly with production volume, such as supplies and indirect labor.

Q2: 11-23.A security for which the cash flows

Q2: On December 5,2014,Unca Corporation,a U.S.firm,bought inventory items

Q5: Default occurs when the borrower fails to:<br>A)

Q10: Gains or losses on foreign currency transactions

Q12: PreBuild Manufacturing acquired 100% of Shoding Industries

Q12: On January 2,2013 Carolina Clothing issued 100,000

Q18: For 95% loan-to-value loans FNMA requires that,as

Q27: 18-13.Subdivision control ordinances are designed to protect

Q33: Par Industries,a U.S.Corporation,purchased Slice Company of New

Q38: 10-27.Prior to the secondary mortgage market it