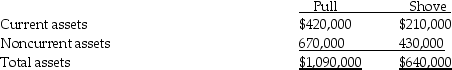

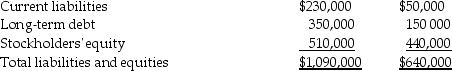

Pull Incorporated and Shove Company reported summarized balance sheets as shown below,on December 31,2014.

On January 1,2015,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2015,with each payment consisting of $30,000 principal,plus accrued interest.

On January 1,2015,Pull purchased 70% of the outstanding capital stock of Shove for $392,000,of which $92,000 was paid in cash,and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31,2015,with each payment consisting of $30,000 principal,plus accrued interest.

The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent)and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts,on the consolidated balance sheet,immediately following the acquisition.

a.Current assets

b.Noncurrent assets

c.Current liabilities

d.Long-term debt

e.Stockholders' equity

Definitions:

Consciousness

The state of being awake and aware of one's surroundings, sensations, thoughts, and experiences.

Visual Deficit

A reduction or impairment in the ability to see, which can range from mild visual disturbances to complete loss of sight.

Gas Appliances

Devices powered by natural gas or propane, including stoves, ovens, water heaters, and dryers, used in residential and commercial settings.

Otic Irrigation

A medical procedure used to clean the outer ear canal by flushing out earwax, debris, and foreign objects with a liquid solution.

Q5: The term "economics of information" refers to

Q12: 12-13.The provisions of a deed of trust

Q19: Packer Corporation owns 100% of Abel Corporation,Abel

Q20: Platts Incorporated purchased 80% of Scarab Company

Q23: The main disadvantage of the C-corporation form

Q32: 20-31.The Real Estate Investment Trust Act authorizes:<br>A)

Q39: 18-30.A rolling option would most likely be

Q43: Pastern Industries has an 80% ownership stake

Q45: Subsequent to an acquisition,the parent company and

Q51: Pinkerton Inc.owns 10% of Sable Company.In the