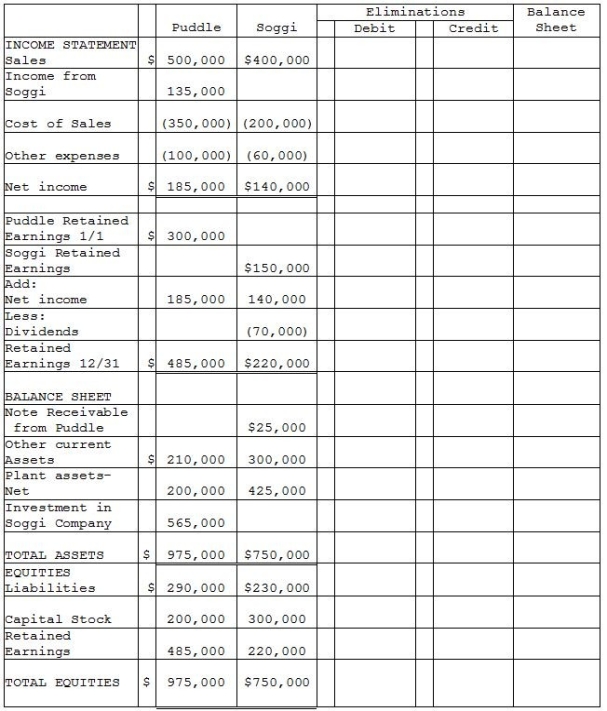

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1,2014 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000.The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets.The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2014,Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi,and on December 31,2014,Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5,2015,but receipt of payment of the note was not reflected in Soggi's December 31,2014 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31,2014.

Definitions:

Common Stock

A type of equity security that represents ownership in a corporation, giving holders voting rights and a share in the company's profits via dividends.

Dividends

Distributions from a company to its shareholders, usually coming from the firm's earnings.

Cumulative Preferred Stock

A type of preferred stock that accrues dividends in the event that any dividends are missed, ensuring that preferred shareholders are paid both missed and current dividends before any are paid to common shareholders.

Common Stock

A type of equity security that represents ownership in a corporation, with voting rights and potential for dividends.

Q1: One method of defining or identifying discriminating

Q7: The treasury stock approach to account for

Q13: 19-18.If an owner sells a property under

Q15: Pheasant Corporation owns 80% of Sal Corporation's

Q18: For 95% loan-to-value loans FNMA requires that,as

Q30: 13-38.In the event that the contract price

Q33: Pascoe's income from Sarabet under the equity

Q37: A promissory note should be:<br>A) sold without

Q38: Palmquist Corporation and its 80%-owned subsidiary,Sadler Corporation,are

Q45: Paglia Corporation owns 80% of Aburn Corporation