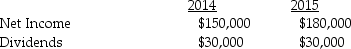

Patterson Company acquired 90% of Starr Corporation on January 1,2014 for $2,250,000.Starr had net assets at that time with a fair value of $2,500,000.At the time of the acquisition,Patterson computed the annual excess fair-value amortization to be $20,000,based on the difference between Starr's net book value and net fair value.Assume the fair value exceeds the book value,and $20,000 pertains to the whole company.Separate from any earnings from Starr,Patterson reported net income in 2014 and 2015 of $550,000 and $575,000,respectively.Starr reported the following net income and dividend payments:

Required: Calculate the following:

Required: Calculate the following:

• Investment in Starr shown on Patterson's ledger at December 31,2014 and 2015.

• Investment in Starr shown on the consolidated statements at December 31,2014 and 2015.

• Consolidated net income for 2014 and 2015.

• Noncontrolling interest balance on Patterson's ledger at December 31,2014 and 2015.

• Noncontrolling interest balance on the consolidated statements at December 31,2014 and 2015.

Definitions:

Supreme Court

The highest federal court in the United States, with ultimate appellate jurisdiction over all federal and state court cases involving issues of federal law.

Political Speech

Expressions related to government, public policy, or elections, often protected from government restriction in democratic societies.

Criminal Procedure

The legal process and rules governing the investigation, prosecution, trial, and punishment of individuals accused of committing crimes.

Burger Court

Refers to the Supreme Court of the United States from 1969 to 1986, under Chief Justice Warren E. Burger, known for significant rulings on abortion, capital punishment, and school desegregation.

Q11: At the beginning of 2014,Parling Food Services

Q12: 12-13.The provisions of a deed of trust

Q17: Diversification involving real estate can take place

Q17: If the bonds were originally issued at

Q24: 18-44.The holding of large parcels of properties

Q36: From the viewpoint of a consolidated entity,the

Q38: The table below provides either a direct

Q39: An entry is necessary to eliminate the

Q48: Controlling interest share in consolidated net income

Q53: Patane Corporation acquired 80% of the outstanding