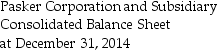

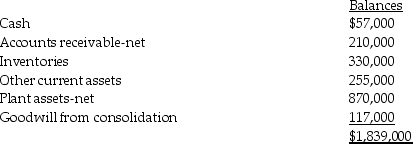

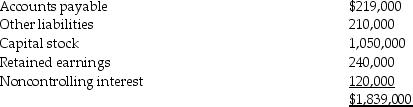

The consolidated balance sheet of Pasker Corporation and Shishobee Farm,its 80% owned subsidiary,as of December 31,2014,contains the following accounts and balances:

Pasker Corporation acquired its interest in Shishobee Farm on January 1,2014,when Shishobee Farm had $450,000 of Capital Stock and $210,000 of Retained Earnings.Shishobee Farm's net assets had fair values equal to their book values when Pasker acquired its interest.No changes have occurred in the amount of outstanding stock since the date of the business combination.Pasker uses the equity method of accounting for its investment.

Pasker Corporation acquired its interest in Shishobee Farm on January 1,2014,when Shishobee Farm had $450,000 of Capital Stock and $210,000 of Retained Earnings.Shishobee Farm's net assets had fair values equal to their book values when Pasker acquired its interest.No changes have occurred in the amount of outstanding stock since the date of the business combination.Pasker uses the equity method of accounting for its investment.

Required: Determine the following amounts:

1.The balance of Pasker's Capital Stock and Retained Earnings accounts at December 31,2014.

2.Cost of Pasker's purchase of Shishobee Farm on January 1,2014.

Definitions:

Available-for-Sale Securities

Financial assets that are not classified as held-to-maturity or trading securities, and can be sold in the short-term to meet liquidity needs.

Security Investments

Investments in tradable financial assets such as stocks, bonds, or other securities aiming for capital appreciation or income generation.

Fair Value

An estimation of the price at which an asset would change hands between willing parties, neither under compulsion to buy nor sell, and both having reasonable knowledge of relevant facts.

Unrealized Loss-Income

Financial losses or gains that have occurred on paper due to changes in asset values but are not realized until the asset is sold.

Q8: A key non-real estate source of property

Q10: The developer is interested in:<br>A) appreciation of

Q12: 16-11."Boot" refers to:<br>A) cash<br>B) non-like-kind property<br>C) relief

Q16: 10-37.The federal agency that guarantees the timely

Q20: The trial balance approach to consolidation workpapers

Q30: On January 1,2014,Packaging International purchased 90% of

Q37: Proceeds from the sale of land are

Q39: The consolidated income statement for Pouch Corporation

Q44: Which one of the following will increase

Q45: The difference between the book value of