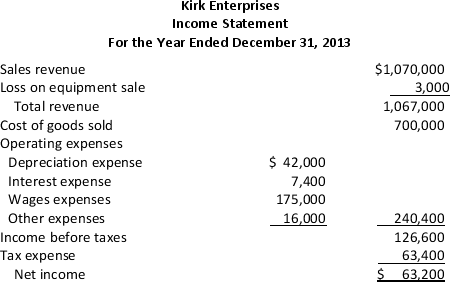

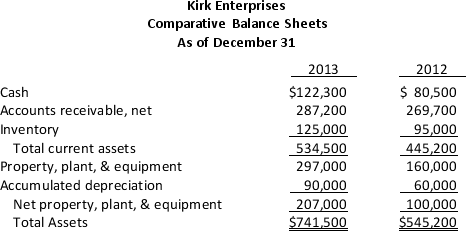

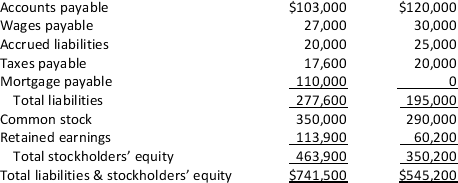

Wil Wheaton,Kirk Enterprises' controller,is preparing the financial statements for 2013.He has completed the comparative balance sheets and income statement,which follow,and has gathered this additional information:

On December 31,2013,Kirk sold a piece of equipment with an original cost of $25,000 for $10,000 cash.The equipment had a book value of $13,000.

On February 1,2013,Kirk issued $60,000 of common stock to raise cash in anticipation of the purchase of a new building later in the year.

On February 2,2013,Kirk took out a ten-year $110,000 long-term loan to provide the remaining funds needed to purchase the building.

On May 15,2013,Kirk paid $162,000 for the new building.

The company paid a cash dividend of $9,500.

Required:

Using the direct method, prepare Kirk Enterprises’ statement of cash flows for 2013.

Definitions:

Organizational Setting

The context within which an organization operates, including its culture, structure, and external environment.

Behavioral View

An perspective that focuses on understanding and analyzing human behavior based on observable actions and reactions.

Creativity

The ability to produce original and valuable ideas or solutions.

Producing New Ideas

The act of generating innovative concepts or solutions that have not been thought of before.

Q7: When using a standard costing system,which of

Q11: The line of causation: of money> inflation>

Q30: Trend analysis is very useful for analyzing

Q42: Which of the following is an example

Q48: In a process costing system, all product

Q50: The formula for calculating ROI is<br>A)Segment margin

Q60: When using the balanced scorecard to monitor

Q73: Lagging indicators can be used to predict

Q119: Investing activities include purchases and sales of

Q132: Explain the difference between a leading indicator