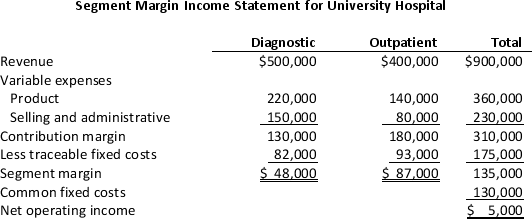

University Hospital provided the following income statement for two of its divisions: Diagnostic and Outpatient.Both divisions are structured as investment centers.

The average assets for Diagnostic and Outpatient divisions total $400,000 and $600,000,respectively.The required minimum rate of return for both divisions is 10%.

The average assets for Diagnostic and Outpatient divisions total $400,000 and $600,000,respectively.The required minimum rate of return for both divisions is 10%.

a.Calculate the current residual income for each division.

b.Why is residual income a better measure of performance for managers of investment centers than the overall profit compared to the flexible budget?

Definitions:

London Interbank Offer Rate

An interest rate average calculated from estimates submitted by leading banks in London that indicates the rate at which banks lend to one another.

Eurodollar Loans

Financial loans that are denominated in U.S. dollars but are held in banks outside the United States.

Overnight

In financial terms, this refers to transactions that are settled or occur from one business day to the next.

Cross-Rate

The exchange rate between two currencies calculated by using a third currency, typically the US dollar, as a reference point.

Q14: The second step in the preparation of

Q45: The market-based price is easily determined by<br>A)Monitoring

Q83: An investment center manager’s performance is typically

Q125: Benchmarking means trying to match another company's<br>A)Matrics.<br>B)Performance.<br>C)Profits.<br>D)Processes

Q129: Barnett Publishing Inc.,reported the following current asset

Q149: Which of the following is a product-

Q151: To calculate the present value of any

Q158: Countless measures could be captured and reported

Q168: Jackson Brothers Instruments sells stringed instruments.Trent Jackson,the

Q169: Barber Manufacturing currently makes 2,000 high-end kaleidoscopes