Use the information for the question(s) below.

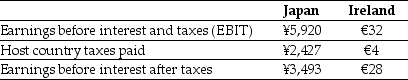

KT Enterprises,a U.S.import-export trading company,is considering its international tax situation.KT's U.S.tax rate is 21%.KT has significant operations in both Japan and Ireland.In Japan the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%.In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%.KT's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are shown here (in millions) :

-The amount of the taxes paid in dollars for the Irish operations is closest to:

Definitions:

Absolute Control

A situation where all power and decisions rest with one entity or individual, without any external influences or checks.

Double Taxation

The imposition of two or more taxes on the same income, asset, or financial transaction.

Sole Proprietorship

A business structure where a single individual owns and operates the business, bearing full responsibility for its assets and liabilities.

Limited Liability

A legal structure that limits the financial liability of the owners to the amount they invested in the company, protecting personal assets from business debts and obligations.

Q9: Trade credit should always be used when

Q12: Which of the following statements is FALSE?<br>A)

Q18: Calgary Doughnuts had sales of $100 million

Q76: A firm currently sells its product with

Q82: With the proper changes it is believed

Q84: Which of the following money market investments

Q85: Assume you want to buy one options

Q96: In which of the following secured loans

Q112: The contribution margin is calculated as<br>A)Sales revenue

Q154: Walker Boat Company produces bass boats.The following