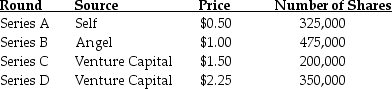

David found a company and goes through the investment rounds shown below:  He decides to take the company public through an IPO, issuing 2 million new shares. Assuming that he successfully completes the IPO, the net income for the next year is estimated to be $8 million. His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses, which is 14. What share of the company will David own after the IPO?

He decides to take the company public through an IPO, issuing 2 million new shares. Assuming that he successfully completes the IPO, the net income for the next year is estimated to be $8 million. His banker informs him that the price of shares should be set using average price-earnings ratios for similar businesses, which is 14. What share of the company will David own after the IPO?

Definitions:

Zoom Function

A feature in digital devices or software that allows the user to magnify or reduce the view of an image or document.

Linear Nature

Describes processes or relationships that follow a straight line or sequence, often referring to communication or thought patterns.

Design Options

Various choices available in the creation or planning of projects, products, or systems, allowing for customization and optimization.

Screencasting Software

A program that allows users to record their computer screens and often their voiceover, used for creating tutorials, presentations, or video guides.

Q29: Which of the following statements is FALSE?<br>A)

Q34: Which of the following statements is FALSE?<br>A)

Q47: Your retirement portfolio comprises 100 shares of

Q54: Which of the following is NOT a

Q56: Historical evidence shows that over the last

Q70: The average annual return over the period

Q72: A project will give a one-time cash

Q79: Assume that MM's perfect capital markets conditions

Q82: There is a clear link between the

Q109: Suppose Blank Company has only one project,