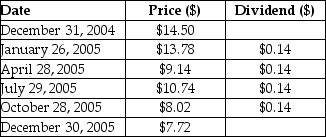

Consider the following price and dividend data for Quicksilver Inc.:  Assume that you purchased Quicksilver's stock at the closing price on December 31, 2004 and sold it after the dividend had been paid at the closing price on January 26, 2005. Your total return rate (yield) for this period is closest to ________.

Assume that you purchased Quicksilver's stock at the closing price on December 31, 2004 and sold it after the dividend had been paid at the closing price on January 26, 2005. Your total return rate (yield) for this period is closest to ________.

Definitions:

Operating Cycles

The period of time it takes for a company to purchase inventory, sell it, and convert the sale into cash.

Property Development

The process of planning, investing in, and building projects on real estate property, including commercial, residential, and industrial projects.

Manufacturing

The process of converting raw materials, components, or parts into finished goods that meet a customer's expectations or specifications.

Current

Pertains to the present time or most recent period.

Q9: Sinclair Pharmaceuticals, a small drug company, develops

Q31: You are considering adding a microbrewery onto

Q33: Food For Less (FFL), a grocery store,

Q48: Jumbo Transport, an air-cargo company, expects to

Q53: Ford Motor Company had realized returns of

Q60: Under-investment problems refers to the problem that

Q62: How can the dividend-discount model handle changing

Q85: An insurance office owns a large building

Q86: The following table summarizes prices of various

Q109: Which of the following statements regarding bonds