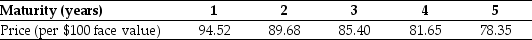

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value) :  Based upon the information provided in the table above, you can conclude ________.

Based upon the information provided in the table above, you can conclude ________.

Definitions:

Equilibrium Price

The price at which the quantity of a good or service demanded by consumers equals the quantity supplied by producers, resulting in a market balance.

Asymmetric Information

Asymmetric information occurs when one party in a transaction has more or better information than the other, potentially leading to an imbalance in the transaction.

Market Transaction

An exchange of goods, services, or financial assets in return for money between parties within a marketplace.

Q10: Explain why a dollar today is worth

Q33: Which of the following bonds will be

Q33: Food For Less (FFL), a grocery store,

Q45: Use the information for the question(s) below.

Q56: Joe pre-orders a non-refundable movie ticket. He

Q61: Which of the following statements is FALSE

Q63: In which of the following situations would

Q68: How can we cross check the statement

Q122: Which of the following is NOT a

Q123: Assuming that your capital is constrained, what