MACRS

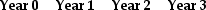

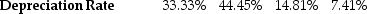

MACRS A machine is purchased for $575,000 and is used through the end of Year 2. The machine will be depreciated using the 3-Year MACRS schedule. At the end of Year 2, the machine is sold for $75,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%?

A machine is purchased for $575,000 and is used through the end of Year 2. The machine will be depreciated using the 3-Year MACRS schedule. At the end of Year 2, the machine is sold for $75,000. What is the after-tax cash flow from the sale of the machine at the end of Year 2 if the firm's marginal tax rate is 35%?

Definitions:

Defective Incorporation

A situation where errors or omissions occur during the incorporation process of a company, potentially affecting its legal status or liability.

Involuntary Dissolution

The legal termination of a corporation's existence without the consent of the corporation, often initiated by a government authority.

Personally Liable

A situation where an individual is responsible for a debt or obligation from their own assets, rather than the liability being limited to business or corporate assets.

Public Corporation

A company whose shares are traded freely on a stock exchange or markets, owned by public shareholders, and subjected to regulatory reporting requirements.

Q6: Firms should use the most accelerated depreciation

Q7: Dusty Corporation is issuing an IPO with

Q33: A 10% APR with quarterly compounding is

Q43: You are borrowing money to buy a

Q57: IGM Realty had stock prices of $33,

Q66: Assume Time Warner shares have a market

Q72: What role does the correlation of two

Q91: The most difficult part of the capital

Q105: Historically, stocks have delivered a _ return

Q106: Investors demand a higher return for investments