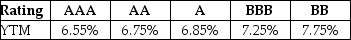

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1,000 and a coupon rate of 7.3% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:  Assuming that Luther's bonds receive a AAA rating, the number of bonds that Luther must issue to raise the needed $25 million is closest to ________.

Assuming that Luther's bonds receive a AAA rating, the number of bonds that Luther must issue to raise the needed $25 million is closest to ________.

Definitions:

Investment Banks

Firms that assist in the design of an issuing firm’s corporate securities and in the sale of the new securities to investors in the primary market.

Public Trading Companies

Corporations whose shares are listed and traded on public stock exchanges, making their ownership publicly accessible.

Adequate Capital

Sufficient funds required by a business to finance its operations and meet its obligations without facing financial distress.

Bank Run

A situation where a large number of a bank's customers try to withdraw their deposits simultaneously because they believe the bank might fail.

Q5: What is the future value (FV) of

Q26: A corporate raider gains a controlling fraction

Q27: Which of the following statements is FALSE?<br>A)

Q45: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1316/.jpg" alt=" A small department

Q51: How can we convert the value of

Q60: Why are the interest rates of U.S.

Q69: What are project externalities?

Q86: A company's board of directors chooses to

Q90: Consider a project with the following cash

Q101: The payback rule is based on the