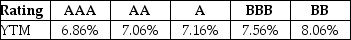

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1,000 and a coupon rate of 5.6% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:  Assuming that Luther's bonds receive a AA rating, the number of bonds that Luther must issue to raise the needed $25 million is closest to ________.

Assuming that Luther's bonds receive a AA rating, the number of bonds that Luther must issue to raise the needed $25 million is closest to ________.

Definitions:

Borrowed Money

Funds that an individual or organization takes from another party under the condition of returning it back in the future often with interest.

Accounting Communication Process

The system by which financial information is identified, measured, recorded, and communicated to interested parties.

External Auditors

Independent third-party professionals who examine a company's financial statements to ensure accuracy and compliance with accounting standards.

Company's Management

Individuals responsible for overseeing the operations and making decisions within a corporation.

Q4: The present value (PV) of a stream

Q6: A study of trading behavior of individual

Q7: A bank offers a loan that will

Q26: A software company acquires a smaller company

Q38: Which of the following would be more

Q39: Valuation models use the relationship between share

Q52: What is the need for the notes

Q71: According to the text, did Enron and

Q102: When the costs of an investment come

Q103: A bond certificate includes _.<br>A) the terms