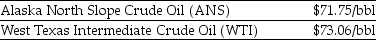

Use the information for the question(s) below.  As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Assuming you currently have 10,000 bbl of WTI crude, the added benefit (cost) to you if you were to sell the  of WTI crude and use the proceeds to purchase and refine ANS crude is closest to ________.

of WTI crude and use the proceeds to purchase and refine ANS crude is closest to ________.

Definitions:

Capital Investment

Funds spent by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment to increase operational efficiency.

Future Net Cash Flows

The estimated total cash income minus the total cash expenses expected over a future period.

Net Present Value

The difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Payback Period

The amount of time it takes for an investment to generate enough returns to recover the original investment cost.

Q15: Clarissa wants to fund a growing perpetuity

Q20: Which of the following investments has a

Q23: When economists measure the aggregate economy and

Q24: Consider the following prices from a McDonald's

Q41: To be broker or to trade securities

Q50: What is the main problem in using

Q59: All of the following variables must be

Q62: Market breadth indicators used by technical analysts

Q81: Use of Generally Accepted Accounting Principles (GAAP)

Q87: Which of the following is not a