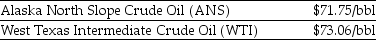

Use the information for the question(s) below.  As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

As an oil refiner, you are able to produce $76 worth of unleaded gasoline from one barrel of Alaska North Slope (ANS) crude oil. Because of its lower sulfur content, you can produce $77 worth of unleaded gasoline from one barrel of West Texas Intermediate (WTI) crude.

Another oil refiner is offering to trade you  of Alaska North Slope (ANS) crude oil for

of Alaska North Slope (ANS) crude oil for  of West Texas Intermediate (WTI) crude oil. Assuming you just purchased

of West Texas Intermediate (WTI) crude oil. Assuming you just purchased  of WTI crude at the current market price, the total revenue (cost) to you if you take the trade is closest to ________.

of WTI crude at the current market price, the total revenue (cost) to you if you take the trade is closest to ________.

Definitions:

Return on Total Assets

A financial ratio that measures the efficiency of a company's use of its assets to generate profit, calculated by dividing net income by total assets.

Available-for-sale Securities

Financial assets that are not classified as held-to-maturity or trading securities, and can be sold in the market.

Q4: The dividend discount model (DDM) cannot be

Q9: Consider the following yields to maturity on

Q25: The management of public companies is not

Q39: Which of the following best illustrates why

Q40: Florida Sports Magazine is a publicly traded

Q58: What is the present value (PV) of

Q62: A firm has contracted to supply 500,000

Q72: Luther Industries needs to raise $25 million

Q79: A stock purchased for $52 paid a

Q81: Martin is offered an investment where for