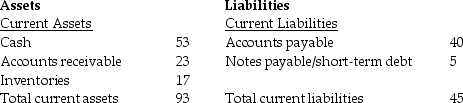

Balance Sheet

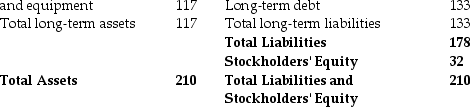

Net property, plant,

Net property, plant, The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

Definitions:

Reliable Test

An assessment method that consistently produces stable and accurate results over repeated applications or administrations.

Valid Test

A test that accurately measures what it is intended to measure.

Extraordinarily Unlikely

An occurrence or event that has a very low probability of happening.

Crystallized Intelligence

The store of information, skills, and strategies that people have acquired through education and prior experiences and through their previous use of fluid intelligence.

Q27: A stock is expected to pay $1.25

Q34: What is a competitive market?<br>A) a market

Q53: In 2007, interest rates were about 4.5%

Q53: Which of the following formulas is INCORRECT?<br>A)

Q80: If the above balance sheet is for

Q86: The following table summarizes prices of various

Q107: What is the real interest rate given

Q133: Ace Hardware's EOQ is 100 widgets, and

Q136: Determining the appropriate amount of total current

Q157: The amount of safety stocks held by