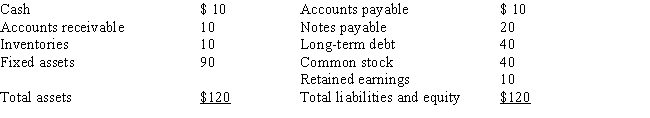

A firm has the following balance sheet:  Fixed assets are being used at 80 percent of capacity; sales for the year just ended were $200; sales will increase $10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

Fixed assets are being used at 80 percent of capacity; sales for the year just ended were $200; sales will increase $10 per year for the next 4 years; the profit margin is 5 percent; and the dividend payout ratio is 60 percent.Assume that fixed assets cannot be sold.What are the total external financing requirements for the entire 4 years, i.e., the total AFN for the 4-year period?

Definitions:

Garden Gnomes

Are small decorative figurines of humanoid creatures, usually placed in gardens, believed to protect the area from evil.

Long-Run Equilibrium

A state in which all factors of production and costs are variable, leading to no economic profit for firms in perfectly competitive markets.

Plaster

A building material used for coating, protecting, and decorating internal walls and ceilings by covering with a thick, smooth surface.

Labor

The physical and mental labor employed in producing goods and services.

Q10: The fixed charge coverage ratio recognizes that

Q10: Which of the following statements is most

Q16: We will generally find that the beta

Q43: S.Claus & Company is planning a zero

Q50: Given the following information, calculate the expected

Q59: A hostile takeover involves an attempt by

Q73: You are given the following information about

Q94: Which of the following is not an

Q98: While the portfolio return is a weighted

Q116: Assume that the average firm in your