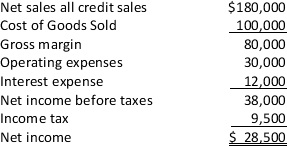

The income statement for Otto Construction Company appear below:  Average total assets total $240,000.Otto's income tax rate is 25%.

Average total assets total $240,000.Otto's income tax rate is 25%.

What is the times interest earned ratio?

Definitions:

Entitlement

A right or benefit guaranteed by law or contract, especially in the context of social welfare or employee benefits.

Qualified Retirement

A retirement plan that meets requirements set forth by the IRS that allows for tax benefits for the employer and employee.

Strict Tax Regulations

Rigorous laws and rules governing the assessment and collection of taxes from individuals and businesses.

Favorable Tax Treatment

Favorable Tax Treatment involves tax policies that are advantageous to businesses or individuals, reducing the amount of taxes owed.

Q5: Which of the following items is more

Q8: The accounts receivable turnover is calculated as

Q10: For the past two years,Monroe Corporation's statement

Q14: The ROI formula decomposed into two components,margin

Q25: Monroe Corporation produced 20,000<br>a.Under the absorption costing

Q46: Which of the following is not an

Q67: A helpful approach to examine changes in

Q100: In a responsibility accounting environment,upper managers evaluate

Q138: Using the direct method of preparing the

Q194: Which of the following is a shortcoming