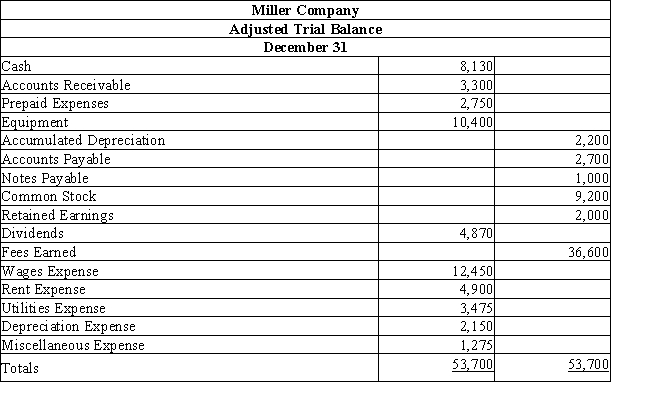

The following is the adjusted trial balance for Miller Company.  Prepare closing entries and the post-closing trial balance.

Prepare closing entries and the post-closing trial balance.

Definitions:

Uncollectible Accounts

Debts owed to a company that are considered to be uncollectable and are therefore written off as a bad debt expense.

Estimated Uncollectible

An accounting term referring to the portion of accounts receivable that a company does not expect to collect.

Allowance Method

is an accounting technique that estimates and reports the likely amount of uncollectible accounts receivable as an allowance for doubtful accounts.

General Ledger Account

A comprehensive record containing all the financial transactions of a business.

Q5: The entry to adjust the accounts for

Q27: Unearned revenues that will be earned in

Q38: Multiple-step income statements show<br>A) gross profit but

Q43: The following balance sheet contains errors.<br><br> <img

Q64: The single-step income statement is easier to

Q108: In a merchandising business, sales minus operating

Q109: The balance of the building account is

Q179: Using the table provided, calculate total sales,

Q185: Inventory system that updates the inventory account

Q272: Assume that the total inventory counted at