On December 31, 20X5, Space Co. purchased 100% of the outstanding common shares of Shuttle Ltd. for $1,200,000 in shares and $200,000 in cash. The statements of financial position of Space and Shuttle immediately before the acquisition and issuance of the notes payable were as follows (in 000s):

SpaceShuttle

Cash Accounts receivable Inventory Property, plant, and equipment Book Value $3605208001,820$3,500 Fair Value $3605008802,000 Book Value $2003804001,420$2,400 Fair Value $2003401,520 Accounts payable Long-term liabilities Common shares Retained earnings $3801,2005001,420$3.500$3801,200$2601000600540$2.400$2601000 The difference in the carrying value and the fair value of the capital assets for Shuttle relates to its office building. This building was originally purchased by Shuttle in January 20X1 and is being depreciated over 30 years.

During 20X6, the year following the acquisition, the following occurred:

1. Shuttle borrowed $350,000 from Space on June 1, 20X6, and was charged interest at 10% per annum, which it paid on a monthly basis. There were no repayments of principal made during the remaining of the year.

2. Throughout the year, Shuttle purchased merchandise of $800,000 from Space. Space's gross margin is 30% of selling price. At December 31, 20X6, Shuttle still owed Space $250,000 on this merchandise; 75% of this merchandise was resold by Shuttle prior to December 31, 20X6.

3. Shuttle paid dividends of $250,000 at the end of 20X6 and Space paid dividends of $500,000.

During 20X7, the following occurred:

1. Shuttle paid $150,000 on the loan payable to Space on May 30, 20X7.

2. Throughout the year, Shuttle purchased merchandise of $1,000,000 from Space. Space's gross margin is 30% of selling price. At December 31, 20X6, Shuttle still owed Space $150,000 on this merchandise; 85% of this merchandise was resold by Shuttle prior to December 31, 20X7.

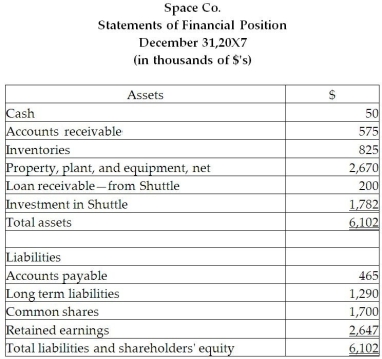

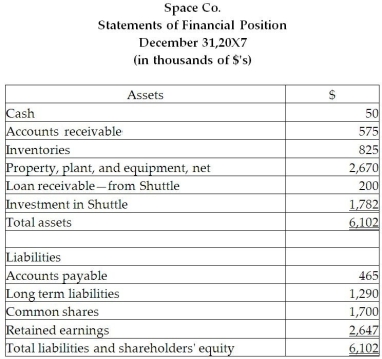

3. Shuttle paid dividends of $250,000 at the end of 20X7 and Space paid dividends of $500,000.  Statements of Changes in Equity - Retained Earnings Section Year Ended December 31, 20X7 (in thousands of $’s) Retained earnings, December 31, 20X6 Net income Dividends declared Retained earnings, December 31, 20X7 Space $1,775990(500)2,265 Shuttle $695490(250)935 Required:

Statements of Changes in Equity - Retained Earnings Section Year Ended December 31, 20X7 (in thousands of $’s) Retained earnings, December 31, 20X6 Net income Dividends declared Retained earnings, December 31, 20X7 Space $1,775990(500)2,265 Shuttle $695490(250)935 Required:

Prepare the consolidated statement of comprehensive income for the year ended December 31, 20X7, for Space.s) } \end{array} \\ \begin{array} { | l | r | r | } \hline & \text { Space \$} & \text { Shuttle \$} \\ \hline \text { Retained earnings, December 31, 20X6 } & 1,775 & 695 \\ \hline \text { Net income } & 990 & 490 \\ \hline \text { Dividends declared } & ( 500 ) & ( 250 ) \\ \hline \text { Retained earnings, December 31, 20X7 } & \underline { 2,265 } & 935 \\ \hline \end{array} \end{array} Required: Prepare the consolidated statement of comprehensive income for the year ended December 31, 20X7, for Space. " class="answers-bank-image d-block" rel="preload" > 11ea84f2_a85b_0257_9a63_4171128d30b3_TB3071_00 Statements of Changes in Equity - Retained Earnings Section Year Ended December 31, 20X7 (in thousands of $’s) Retained earnings, December 31, 20X6 Net income Dividends declared Retained earnings, December 31, 20X7 Space $1,775990(500)2,265 Shuttle $695490(250)935 Required:

Prepare the consolidated statement of comprehensive income for the year ended December 31, 20X7, for Space.s) } \end{array} \\ \begin{array} { | l | r | r | } \hline & \text { Space \$} & \text { Shuttle \$} \\ \hline \text { Retained earnings, December 31, 20X6 } & 1,775 & 695 \\ \hline \text { Net income } & 990 & 490 \\ \hline \text { Dividends declared } & ( 500 ) & ( 250 ) \\ \hline \text { Retained earnings, December 31, 20X7 } & \underline { 2,265 } & 935 \\ \hline \end{array} \end{array} Required: Prepare the consolidated statement of comprehensive income for the year ended December 31, 20X7, for Space. " class="answers-bank-image d-block" rel="preload" > Statements of Changes in Equity - Retained Earnings Section Year Ended December 31, 20X7 (in thousands of $’s) Retained earnings, December 31, 20X6 Net income Dividends declared Retained earnings, December 31, 20X7 Space $1,775990(500)2,265 Shuttle $695490(250)935 Required:

Prepare the consolidated statement of comprehensive income for the year ended December 31, 20X7, for Space.s) } \end{array} \\ \begin{array} { | l | r | r | } \hline & \text { Space \$} & \text { Shuttle \$} \\ \hline \text { Retained earnings, December 31, 20X6 } & 1,775 & 695 \\ \hline \text { Net income } & 990 & 490 \\ \hline \text { Dividends declared } & ( 500 ) & ( 250 ) \\ \hline \text { Retained earnings, December 31, 20X7 } & \underline { 2,265 } & 935 \\ \hline \end{array} \end{array} Required: Prepare the consolidated statement of comprehensive income for the year ended December 31, 20X7, for Space. " class="answers-bank-image d-block" rel="preload" > 11ea84f2_a85b_0257_9a63_4171128d30b3_TB3071_00 Statements of Changes in Equity - Retained Earnings Section Year Ended December 31, 20X7 (in thousands of $’s) Retained earnings, December 31, 20X6 Net income Dividends declared Retained earnings, December 31, 20X7 Space $1,775990(500)2,265 Shuttle $695490(250)935 Required:

Prepare the consolidated statement of comprehensive income for the year ended December 31, 20X7, for Space.

Definitions:

Multiply

The arithmetic operation of scaling one number by another, essentially repeated addition.

Multiply

The arithmetic process of calculating the result of adding a number to itself a certain number of times.

Simplify

To simplify means to reduce an expression or equation to its simplest form, by combining like terms, reducing fractions, etc.

Combine

The process of uniting two or more expressions into a single expression using mathematical operations.

Required:

Required: