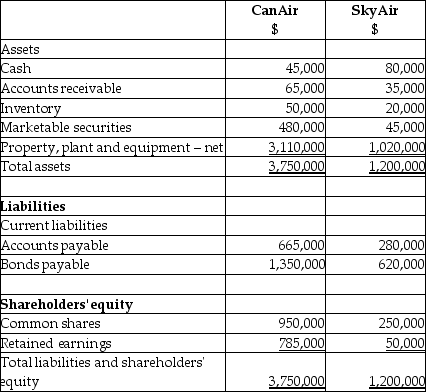

On September 1, 20X7, CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc. for $1,215,000. CanAir will pay for this acquisition by cashing in all of its marketable securities and issuing share capital for the remaining amount. The balances showing on the statement of financial position for the two companies at August 31, 20X7, are as follows:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, CanAir determines that some of the assets of SkyAir have fair values different from their carrying values. These items are listed below:

Property, plant, and equipment: Fair value is $1,350,000

Internet domain name: Fair value is $55,000

Customer lists: Fair value is $35,000

In addition, SkyAir has tax losses available for carryforward that have a fair value of $225,000 and it is probable that they will be realized in the future.

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1, 20X7.

Definitions:

Motown Historical Museum

A museum located in Detroit, Michigan, that preserves the legacy of the Motown Record Corporation, including artifacts, photographs, and music exhibits.

Esther Gordy Edwards

An influential figure in the music industry best known for her work with Motown Records and preserving its legacy.

Correctly Punctuated

Properly employing punctuation marks according to grammatical rules within a text to enhance clarity and readability.

Jumper Cables

Electrical cables with clamps at either end used to connect a discharged battery to a power source for starting a vehicle.

Q4: Hattrick Corp. is a wholly owned,

Q5: Phan Ltd., a Canadian company, sold goods

Q27: Big Research Foundation is a large not-for-profit

Q30: Which of the following would be a

Q32: Using the formula, gearing ratio = long-term

Q35: The calculation of the NCI on the

Q36: How is negative goodwill treated in accounting

Q39: A private company that is closely held

Q39: Accountants design accounting information systems and analyze

Q93: The process in which accountants help managers