On September 1, 20X7, Spike Limited decided to buy 100% of the outstanding shares of Volley Inc. for $1,200,000, paid for with the issuance of shares. Acquisition costs for the deal totaled $30,000: $20,000 related to the issue of the shares and the remaining amount for legal, valuation, and administrative costs. All of these costs were paid in cash. In addition Spike has agreed to pay an additional $250,000 if the revenues of Volley have a 5% growth over the next two years from the date of the acquisition. It has been determined that the fair value of this contingent consideration is $175,000.

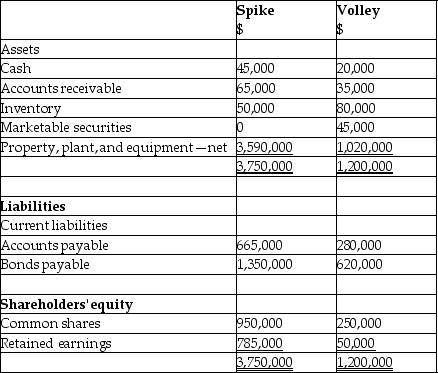

The balances showing on the statement of financial position for the two companies at August 31, 20X7, are as follows:

After a review of the financial assets and liabilities, Spike determines that some of the assets of Volley have fair values different from their carrying values. These items are listed below:

After a review of the financial assets and liabilities, Spike determines that some of the assets of Volley have fair values different from their carrying values. These items are listed below:

Property, plant, and equipment: fair value is $1,350,000

Patent: fair value is $255,000

Brand name: fair value is $135,000

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1, 20X7.

Definitions:

Major Organic Product

The main product produced in the greatest quantity from an organic chemical reaction.

Reaction Sequence

An orderly series of chemical reactions where the product of one reaction becomes the reactant in the next.

Diethyl Malonate

An ester derived from malonic acid, used in synthetic organic chemistry for the synthesis of various compounds.

Major Organic Product

The chief compound that results in the largest amount during an organic chemistry process.

Q1: Which of the following statements is incorrect?<br>A)It

Q8: A few years ago, Locke Ltd. purchased

Q9: Assume that the transaction qualifies as a

Q18: What is a structured entity? How is

Q18: What adjustment should be made to

Q26: During 20X1, Siro sold $7,000 of

Q34: <br>Chua has a June 30 year-end. What

Q40: Ten years later, Belzer is still using

Q44: For private enterprises that use the current-rate

Q71: _ design the accounting information system and