Answer the following questions using the information below:

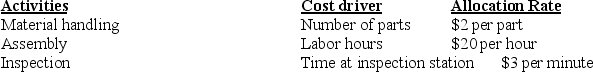

Nichols, Inc., manufactures remote controls. Currently the company uses a plant-wide rate for allocating manufacturing overhead. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers:

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $200 per labor hour.

The current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $200 per labor hour.

-What are the indirect manufacturing costs per remote control assuming the traditional method is used and a batch of 500 remote controls are produced? The batch requires 1,000 parts, 10 direct manufacturing labor hours, and 15 minutes of inspection time.

Definitions:

Q20: If manufacturing overhead costs are considered one

Q63: If the facility lease expense of $350,000

Q100: Unit-level measures can distort product costing because

Q110: For every $25,000 of ticket packages sold,

Q145: What is budgeted gross margin for March

Q145: Indirect materials that are requisitioned increase the

Q150: If a cost is considered controllable, it

Q177: A variance is:<br>A)the gap between an actual

Q184: When a greater proportion of costs are

Q190: What is the breakeven point assuming the