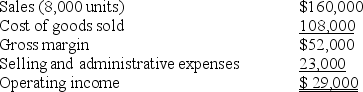

Moore Company prepared the following absorption-costing income statement for the year ended May 31, 2011.

Additional information follows:

Additional information follows:

Selling and administrative expenses include $1.50 of variable cost per unit sold. There was no beginning inventory, and 8,750 units were produced. Variable manufacturing costs were $11 per unit. Actual fixed costs were equal to budgeted fixed costs.

Required:

Prepare a variable-costing income statement for the same period.

Definitions:

Unsystematic Risk

The risk associated with a specific company or industry that can be mitigated through diversification.

Systematic Risk

The risk inherent to the entire market or market segment, also known as market risk or un-diversifiable risk.

Risk Premium

The additional return required by investors for taking a higher level of risk, compared to a safer investment.

Recession

A significant decline in economic activity spread across the economy, lasting more than a few months, visible in GDP, real income, employment, industrial production, and wholesale-retail sales.

Q17: Opportunity costs:<br>A)result in a cash outlay<br>B)only are

Q18: Sunk costs:<br>A)are relevant<br>B)are differential<br>C)have future implications<br>D)are ignored

Q38: In the above chart, the amounts for

Q41: A nonfinancial measure of performance evaluation is:<br>A)increased

Q53: Improvement opportunities are easier to identify when

Q65: Tessmer Manufacturing Company produces inventory in a

Q101: The high-low method is more accurate than

Q102: Effective planning of variable overhead includes all

Q104: What is cost of goods sold per

Q194: What is the expected balance in Accounts