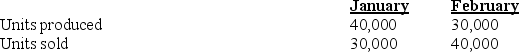

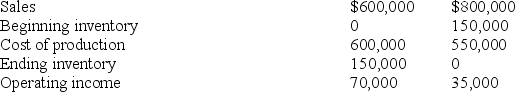

The manager of the manufacturing division of Iowa Windows does not understand why income went down when sales went up. Some of the information he has selected for evaluation include:

The division operated at normal capacity during January.

The division operated at normal capacity during January.

Variable manufacturing cost per unit was $5, and the fixed costs were $400,000.

Selling and administrative expenses were all fixed.

Required:

Explain the profit differences. How would variable costing income statements help the manager understand the division's operating income?

Definitions:

Scrap Value

Scrap Value is the estimated residual value of an asset at the end of its useful life, representing what can be recovered from selling the asset as scrap or for parts.

Straight-Line Method

A method of calculating depreciation of an asset where the expense is evenly distributed over its useful life.

Scrap Value

The estimated resale value of an asset at the end of its useful life, often considered when calculating depreciation.

Units-Of-Production Method

A depreciation method that allocates expense based on the actual usage or production levels of the asset.

Q35: If Donald's Engine Company purchases 1,000 TE456

Q35: When using activity-based costing all of the

Q40: The fundamental purpose of responsibility accounting is

Q44: Kaiser Company just hired its fourth production

Q70: Relevant costs of a make-or-buy decision include

Q85: In a 2-variance analysis the flexible-budget variance

Q114: A variance is the difference between the

Q139: Which of the three product models should

Q144: Sometimes qualitative factors are the most important

Q172: Managers face uncertainty when estimating:<br>A)demand of the