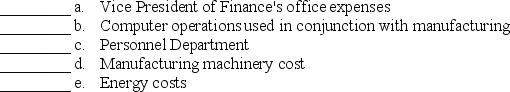

For each cost pool listed select an appropriate allocation base from the list below. An allocation base may be used only once. Assume a manufacturing company.

Allocation bases for which the information system can provide data:

1. Number of employees per department

2. Employee wages and salaries per department

3. Production facility square footage

4. Hours of operation of each production department

5. Machine hours by department

6. Operations costs of each department

7. Hours of computer use per month per department

8. Indirect labor-hours per department

Cost pools:

Definitions:

Compounded Annually

Interest calculation method where the interest is calculated once a year and added to the principal sum, affecting the next year's interest calculation.

Quarterly Withdrawals

Periodic withdrawals from an investment or savings account that occur every three months.

Deposit

Funds placed into a financial institution for safekeeping, often to accrue interest over time; could also refer to a payment made in advance as a commitment or partial payment.

Retirement Savings Plan (RSP)

A financial arrangement designed to help individuals save for their retirement.

Q7: Which of the following manufactured products would

Q19: Businesses offer bundled products to:<br>A)increase customer exposure<br>B)increase

Q23: Using the sales value at splitoff method,

Q25: Which of the following journal entries records

Q27: What is the estimated net realizable value

Q48: Discretionary costs arise from periodic (usually yearly)decisions

Q84: The president of the Gulf Coast Refining

Q117: Proper costs allocation for inventory costing and

Q156: What is the cost effect of the

Q160: If Ms. Sushi wanted a long-term commitment