Answer the following questions using the information below:

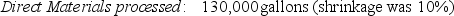

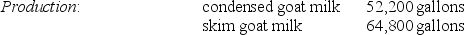

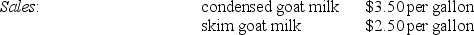

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

-Using the sales value at splitoff method, what is the gross-margin percentage for skim goat milk at the splitoff point?

Definitions:

Average of Five Meals

The arithmetic mean value of the caloric or nutritional content of five different meals.

Cupholders

Features in vehicles and furniture designed to securely hold cups or mugs, preventing spills.

Meals a Year

A term referring to the total number of meals consumed or provided over the course of a year.

Indirect Quotations

Statements that report what someone has said without using the person's exact words, typically introduced by a phrase like "he said that" or "she believes that."

Q7: If Brian Company has a safety stock

Q45: Which of the following is NOT one

Q93: To evaluate the success of its strategy,

Q94: Homogeneous cost pools lead to:<br>A)more accurate costs

Q96: Using estimated net realizable value, what amount

Q119: What is the total sales-mix variance in

Q122: If Jackson Collectibles, Inc. has a safety

Q129: If the stand-alone method were used, what

Q157: What is operating income for 2012?<br>A)$1,045,000<br>B)$726,000<br>C)$486,000<br>D)$476,000

Q162: A favorable sales-quantity variance would most likely