Answer the following questions using the information below:

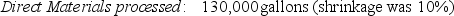

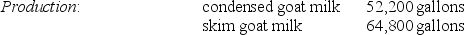

The Gows Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

The costs of purchasing the 130,000 gallons of unprocessed goat milk and processing it up to the splitoff point to yield a total of 117,000 gallons of salable product was $144,480. There were no inventory balances of either product.

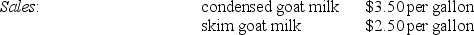

Condensed goat milk may be processed further to yield 39,000 gallons (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable gallon. Xyla can be sold for $18 per gallon.

Skim goat milk can be processed further to yield 56,200 gallons of skim goat ice cream, for an additional processing cost per usable gallon of $2.50. The product can be sold for $9 per gallon.

There are no beginning and ending inventory balances.

-Using estimated net realizable value, what amount of the $72,240 of joint costs would be allocated Xyla and the skim goat ice cream?

Definitions:

Technical Support

Assistance provided to users of technology products or services, often relating to troubleshooting and problem-solving.

Virtual Teams

Groups of people who work together from different geographical locations and rely on communication technology such as email, video or voice conferencing, and file sharing.

Physically Dispersed Teams

Groups whose members are located in different physical locations and often coordinate their work through technology.

Physical Distance

The measurable space between people, which can impact interactions and the dynamics of social and professional relationships.

Q26: The single-rate cost-allocation method may base the

Q50: Under the incremental method of allocating common

Q53: Scrap is usually divided between normal and

Q62: Accounting for rework in a process-costing system:<br>A)accounts

Q65: The costs of normal spoilage are typically

Q82: If a cost pool is homogeneous, the

Q117: Which of the following statements about the

Q143: To manage setup costs, a corporation might

Q155: What is operating income in 2012?<br>A)$1,440,000<br>B)$1,804,500<br>C)$364,500<br>D)$200,000

Q165: More insight into the efficiency variance for