Answer the following questions using the information below:

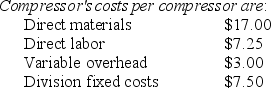

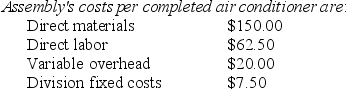

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 150% of variable costs?

Definitions:

Rewarding Performance

Practices and policies designed to recognize and reward employees based on their job performance, aimed at motivating and retaining talent.

Effective Discipline

The implementation of strategies and measures to correct behavior and ensure rules and standards are maintained in an organization or individual practice.

Commitment to Results

A focus on achieving specific outcomes or objectives, demonstrating dedication and persistence toward goal accomplishment.

Effective Delegation

The process of assigning responsibilities and authority to others in a manner that maximizes efficiency and outcomes.

Q3: What is the transfer price per barrel

Q21: Quality of design measures how closely the

Q70: If an oil refinery used refinery down-time

Q71: Just-in-time systems are similar to materials requirement

Q72: Which of the following is NOT a

Q92: Dawn and Kim just bought a bed

Q103: The Zeron Corporation wants to purchase a

Q121: What is the total production per day

Q135: Generally, costs which are initially recorded as

Q158: Assigning direct costs poses more problems than