Answer the following questions using the information below:

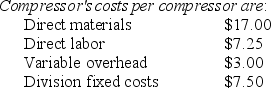

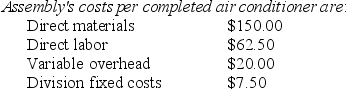

Calculate the Division operating income for the Artic Air Company which manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division. The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells it to retailers. The Compressor Division "sells" compressors to the Assembly Division. The market price for the Assembly Division to purchase a compressor is $38.50. (Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units. The fixed costs for the Assembly Division are assumed to be $7.50 per unit at 10,000 units.

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the transfer price per compressor is 110% of full costs?

Definitions:

Test Questions

Items on an exam designed to assess the knowledge, skills, or abilities of those taking the test.

Knowledge Development

The process of acquiring, creating, and expanding understanding or information in a specific area or field.

Cultural Identity

The sense of belonging to a group that shares common cultural traits, such as language, religion, and traditions.

Newly Introduced Culture

A culture that has been recently established or brought into an area, group, or society, often bringing new customs, beliefs, or practices.

Q24: For best results, cost management emphasizes independently

Q40: Shazam Machines produces numerous types of money

Q57: The Custom Shirt House is concerned about

Q58: An important advantage of decentralized operations is

Q58: What is the inspection cost per unit?<br>A)$30.40<br>B)$7.60<br>C)$3,800<br>D)$4,000

Q59: When rework is normal and NOT attributable

Q60: The prices negotiated by two divisions of

Q82: An important advantage of the net present

Q93: Which of the following statements would be

Q106: The obtain information stage of capital budgeting