Use the information below to answer the following question(s) .

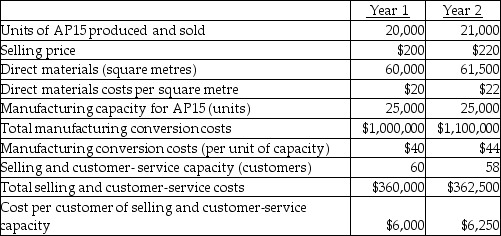

Following a strategy of product differentiation, Luke Company makes a high-end Appliance, AP15. Luke Company presents the following data for the years 1 and 2.

Luke Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in year 2. Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced. Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support. Neither conversion costs or customer-service costs are affected by changes in actual volume. Luke Company has 46 customers in year 1 and 50 customers in year 2. The industry market size for high-end appliances increased 5% from year 1 to year 2.

Luke Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in year 2. Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced. Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support. Neither conversion costs or customer-service costs are affected by changes in actual volume. Luke Company has 46 customers in year 1 and 50 customers in year 2. The industry market size for high-end appliances increased 5% from year 1 to year 2.

-What is the revenue effect of price-recovery component?

Definitions:

EAR

Effective Annual Rate (EAR) is a measure of interest that takes into account the effects of compounding over a given period.

Compounded Monthly

Interest calculated on an investment or loan each month based on both the initial principal and the accumulated interest from previous months.

EAR

Effective Annual Rate, a measure of interest that takes into account the effect of compounding over a year.

Compounded Quarterly

The process whereby the interest earned on an investment is calculated and added to the principal sum every three months, then the new total is used for the next compounding period.

Q8: What is the approximate portion of the

Q26: The productivity component measures the reduction in

Q33: Hunt Company and Indio Company are noncompeting

Q44: Total factor productivity (TFP) is easy to

Q45: Under the stand-alone method of allocating common

Q81: John Peters is drafting the provisions of

Q101: What are the estimated total costs if

Q113: Required:<br>a. What amount is the revenue effect

Q122: What are the target sales revenues?<br>A) $1,380,000<br>B)

Q125: Holding fixed cost and unit contribution margin