Answer the following question(s) using the information below:

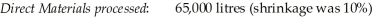

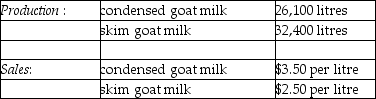

The Morton Company processes unprocessed goat milk up to the splitoff point where two products, condensed goat milk and skim goat milk result. The following information was collected for the month of October:

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

The costs of purchasing the 65,000 litres of unprocessed goat milk and processing it up to the splitoff point to yield a total of 58,500 litres of salable product was $72,240. There were no inventory balances of either product.

Condensed goat milk may be processed further to yield 19,500 litres (the remainder is shrinkage) of a medicinal milk product, Xyla, for an additional processing cost of $3 per usable litre. Xyla can be sold for $18 per litre.

Skim goat milk can be processed further to yield 28,100 litres of skim goat ice cream, for an additional processing cost per usable litre of $2.50. The product can be sold for $9 per litre.

There are no beginning and ending inventory balances.

-How much (if any) extra income would Morton earn if it produced and sold skim milk ice cream from goats rather than goat skim milk? Allocate joint processing costs based upon the relative sales value at the splitoff point.

Definitions:

Credit Sales

Sales made on credit, allowing customers to purchase goods or services and pay for them at a later date.

Loss from Sale

An unfavorable difference between the selling price of an asset and its book value, leading to a financial loss for the entity.

Assets

Resources owned or controlled by a business, expected to bring future economic benefits.

Liabilities

Liabilities or monetary duties a firm has towards outside entities.

Q14: Spoilage can be attributed to a particular

Q14: Taylor Stadium is evaluating ticket prices for

Q22: Marble Shop manufactures marble products. All direct

Q61: 24-hour customer service not traceable to an

Q108: What is the number of total spoiled

Q109: What is the estimated net realizable value

Q112: Caulfield Ltd. has two production departments in

Q120: When budgeted cost-allocation rates are used, managers

Q126: A COQ report provides information on individual

Q127: The president of Sampson Ltd. has approached